I have been incredibly curious about content and distribution this year and I have a half draft demonstrating that content is the only reason why companies get big. You can read it here, just know that it is not the best-written essay and I have updated my thoughts to a more meta version of the draft, but I am happy to get your feedback on the ideas shared in it.

I am often thinking about how the biggest companies get big, especially consumer companies, and I do not think the business books I have read give a definite answer. It’s always a mix of factors and those things are sometimes hard to replicate. I recently arrived at an answer and I believe companies grow huge because they own demand. If you own demand, you can bend supply.

Owning demand ties in with my universal theory of content, and it is the summary of everything on why companies get big. I have made several tweets around owning demand, and I want to break them down and get your thoughts.

But first, here is why owning demand became the apparent answer to me.

This post by Kevin kwok, one of my favorite people to follow on Twitter, mentioned Rich Barton’s play book to founding billion dollar companies - Expedia, Glassdoor, Zillow. It is obvious that they all grew on SEO. But SEO is not the reason he captured demand, SEO was just the distribution channel. The content format was the answer - he created differentiated supply early on.

Another post that helped was, Why DTC brands expand to services. It is a little bit off-topic on owning demand, but some ideas in it help demonstrate why owning demand should be the goal.

To my tweets

Not my tweet. Just posted this first to demonstrate why owning demand is not as common as it should be. It is hard. It is easier to buy traffic from FB or get high off or organic traffic from search engines.

Owning demand through differentiated content

A great example of this is Netflix. Before they became what they are today - an online VOD producing content, they aggregated movie selections and allowed people borrow CDs just like blockbuster, but through mail order deliveries. They later moved into letting people watch these movies online, but they owned none of the titles.

Netflix had built a good business, but not a defensible business. They knew how to acquire customers and probably retain customers, but they did not own demand. Why? Because their content was not differentiated. Netflix paid movie producers and networks to stream their content to its audience. People came to view the content, but they did not come for Netflix, they came for the content. This meant Disney or any network could pull all their titles overnight to their own streaming service, and Netflix could lose a lot of subscribers by the next month.

Beyond that, Netflix was exposed to wholesale transfer pricing risk - there are a handful of producers that can keep raising prices which squeezes Netfilx to raise prices to consumers, which angers consumers, but the movie networks and producers get richer and can compete with Netflix with the pockets Netflix made fat.

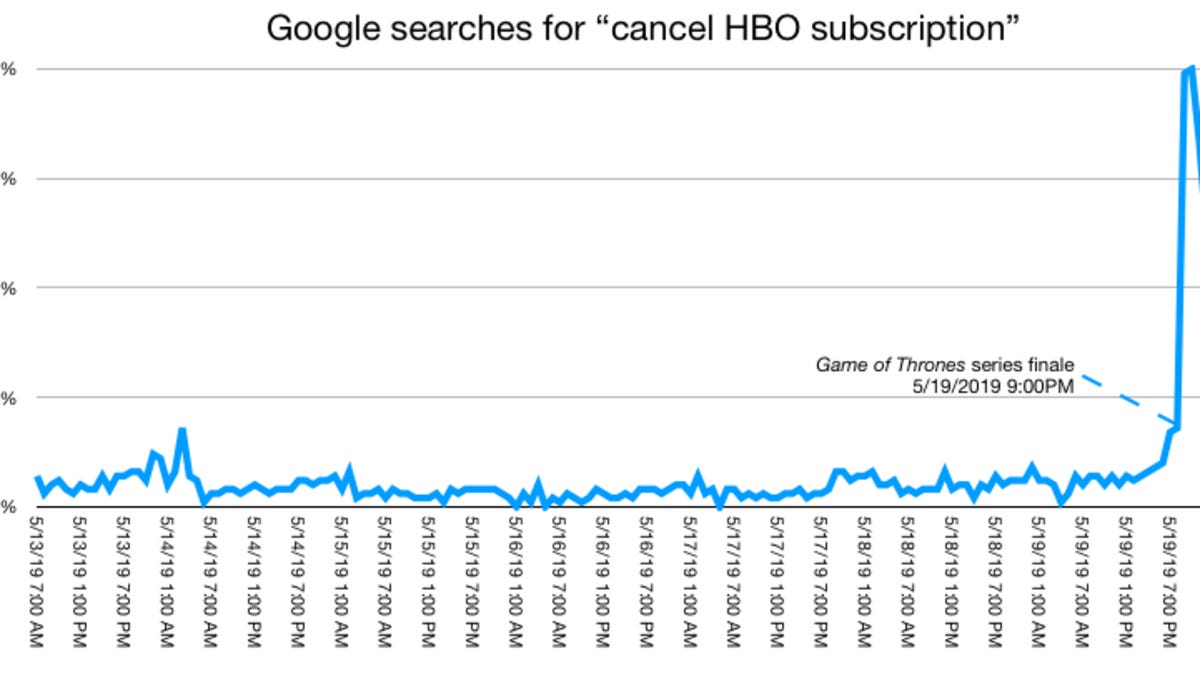

We saw the former risk factor (owning movie titles) happen with HBO. After Game of Thrones ended, Google searches for "Cancel HBO subscription" spiked.

Netflix got around this problem by creating differentiated content by creating new supply. To achieve this, they had to go down the stack by unlocking and transforming the data they aggregated on users into data loops. They had information on what people wanted and produced those movies their audience wanted. The more they do it, the bigger the effect of their data loop.

This has worked well for them, and clear evidence of this is that they were able to rack up 80 million views on Birdbox, the Sandra Bullock movie about the end of the world, after a month of release.

I highly recommend you read this Twitter thread on Netflix Vs Blockbuster from one of my favorite people to follow on Twitter. The story is the definition of serendipity. If all those events did not happen in the way they happened, we might not have the Netflix we know today

Another example of differentiated supply is Google Maps.

Google search started by aggregating all content on the web and that worked well because they had differentiated supply. People did not use Google because they knew they could find a textbook on a subject as you would in a library. They used Google because Google gave a new kind of supply, howbeit by occupying the entire tail of information.

However, Google went down the stack with Maps to create differentiated supply by calling data they had aggregated into action just like Netflix did. Google Maps had roads and locations (data/content), then used that data to create a data loop that enriched Maps with hotels, and restaurants which gave them a wider listing than Tripadvisor. But to own demand, they had to differentiate supply from Tripadvisor by curating reviews, pictures, and giving the owners of restaurants, hotels, and businesses the ability to enrich the bland data Maps originally had. The more data that was added, the better the product got, which attracted more data - Google’s data loop.

Now, on every earnings call huge travel companies mention Google as their biggest competitor. The same Google that they all grew big on through SEO (search engine optimization) and SEM (search engine marketing). I suspect this is why Tripadvisor pivoted to a social network earlier this year.

Old theory of content was to get all the content you could - get all of the longtail. In that old world, Netflix would have preferred to stock all movie titles instead of going down the stack and creating differentiated supply on their movie titles. Stocking all the movies will give them lots of growth and traction, but it would not be as defensible as their current business.

New theory of content is to occupy a section of the tail and dig deep into it, so that you can create differentiated supply. Creating differentiated supply creates a better product.

Uber is a third example, they created differentiated supply early on, but suffered from multi-tenanting, the same driver can drive on multiple ride hailing apps. To improve the product and create more differentiated supply, they layer additional services on the Uber app like Uber Eats. Scooters, et al which increases frequency of usage (more on this in the next section). This differentiates their supply even further, helps them create a better product, and their grip on owing demand tightens.

Imagine the scenario in my tweet below. This was in response to Uber’s new Ubercopter service. When you own demand, you can bend supply, and when you create new/differentiated supply you are able to own demand even further. The feedback loop reinforces itself.

To create differentiated supply, you need to build distribution

Without distribution, you will be unable to figure out the economics of content and without the right content you cannot get to build distribution channels that let you own demand.

Innovative companies are famous for removing friction from a consumer activity.

Make it 10x easier to get a cab, and you get ride hailing apps everywhere.

Make it 10x easier to transfer money, and you get USSD banking from every bank.

Make it 10x easier to travel long distances in short periods, and you get cars and airplanes everywhere.

Make it 10x easier to remain in good health, and you get hospitals everywhere.

Make it 10x easier to send messages, and you get ubiquitous instant messaging.

Most innovative companies in this age are tech companies.

Word of mouth was the original distribution channel. Then we got transportation, telecommunication, shopping malls, The internet, Google, Amazon, Facebook, et al.

Whenever you remove friction, you create abundance.

All these distribution channels did something in common. They took a human activity, that was hard and painful to perform, removed the friction in that activity, 10X’d the experience of that activity and created abundance. E.g: Shopping is hard. Find everything you need in one store (abundance). I am yet to see a scenario where eliminating friction and creating a 10x experience did not lead to abundance.

Consumer companies built on the internet, D2C brands, are often tech-enabled which gives them the ability to aggregate data across millions of customer habits, which essentially forms a data loop that helps them improve their product. The uniqueness of these consumer companies compared to their traditional CPG counterparts that do not have that data relationship with their customers allow these D2C brands to go down the stack in new ways that help them unlock differentiated supply.

It is common knowledge that acquisition costs on mainstream distribution channels - Facebook and Google - and the cost of getting organic visibility is unsustainable for an internet consumer company building a big business. So it has become imperative to do the work of going down the stack and Quip, the smart toothbrush company, knows it.

With the aggregated data these D2C companies have, they can create new supply on the demand they built with the customer relationship they own. Now, Quip is digging down the stack to sell dental insurance and it makes absolute sense.

What I see as the future

My notes on Quip above demonstrate this phenomenon that I expect to see in the future.

A company that I think is ripe to capture this trend is Away, the luggage company. They built tech into luggages and built an interesting brand that generates a lot of UGC in a very unsexy category. To keep growing at the pace their venture partners expect they need to dig deeper. Luckily, they are in travel, one of the biggest niches on the internet.

Imagine this scenario:

With Away’s tech and branding, they are able to know where their customers visit and indulge them to create user generated content on their trips. Rather than do customer reviews of places of interest like TripAdvisor, they can create differentiated content by getting UGC on topics such as "2 days in Bogota", "How to spend 72 hours in Paris", "Where to spend an afternoon in Accra", et al.

This kind of content is rich and differentiated when done at scale with user generated content (UGC), proper design, and right technology. If this happens, Away would have dug deeper on the tail they occupy by leveraging data on customer habits and transforming that data to create a UGC engine that creates truly differentiated content.

Doing this (1) lowers their acquisition costs (2) Gives them a new revenue stream as they can monetize their content by enabling transactions between the customer and place being visited (3) They can act as distribution channels for travel companies that want to reach the audience they now own.

The easiest thing Away can do is to give up on doubling down on owning demand to focus on making sales by making sure they occupy the long tail of luggage shopping

How does content drop your acquisition costs (CAC)

Often, when a product is created it is created in one place. When you duplicate your product to appear or to be distributed in as many places as possible, then you have content. When you scale your content, then your content has a long tail. The long tail of your content fetches you customers without you forking out a penny. This is how content pays for itself.

Example: Hotel booking sites get a lot of traffic from search engines because they list many hotels and many cities. Each page on a hotel booking site drives traffic to the site. So if I have a "100K" pages, I might get X amount of traffic. And if I had a million pages on my site, I would get "10X" amount of traffic. If I create a hotel booking site that has 1 million hotels, but I had only one page on my website, my customers can hardly find me through search and I will have to increase my brand marketing spend to get a lot of direct traffic, hence my CAC will always rise. But if I had a million pages, my CAC will fall.

Another Example: If I were Unilever, and sold deodorants it would be super-important that I have my deodorant product in every store because my customer acquisition cost rises if customers cannot find me everywhere they look. Having my content in every store pays for itself because people I could not reach with advertising will enter the stores and find my product.

The ubiquity of these products on the channel they distribute themselves against is the long tail of content.

Recap

How do you own demand? You own demand through ubiquitous differentiated content. The ubiquity is a function of the distribution channel and your ability to scale content on that channel. There are various content formats to capture demand

Brand: Own demand through share of wallet. The more I see your brand in the way that makes me want to consume it, the more I will allocate money to buy your product over any other product I would have bought. E.g: Coca-Cola

UGC: Own demand by getting people to share information willingly at scale. Here, I consistently find high quality information/content I want to consume regularly on a specific site and that information is always brand new. E.g: Twitter.

Referrals/Invites: Own demand through networking friends. If all my friends are doing something, then I definitely want to join. E.g: WhatsApp.

Influence: Own demand by owning real life status of entities. If the entities and people I trust, follow, like, are aggregated in one place I will be there. E.g: Youtube

Supply: Own demand by aggregating all supply. If I can compare and find the best accommodation for my budget when I travel to a new city, then I will use that service. E.g: Airbnb, Tripadvisor.

There are a lot more content formats and you can invent more as long as you are smart about the distribution. Snapchat invented ephemeral stories and that thing is everywhere now.

Lastly, content is great, but if you do not figure out your distribution flywheel or loops the economics will never add up. To understand loops better, read Advantage Flywheels.

House Keeping

I share my early ideas in this newsletter to get feedback that makes everyone smarter. So please, tell me the new insights you gained and point out where you think my ideas are flawed. Important rules when contributing are:

Zoom out and observe what is and untrue.

Do not focus on semantics, unless absolutely necessary.

Always be honest in your thinking. Intellectual dishonesty & being disingenuous gets me off the wrong way.

Attack ideas as aggressively as you wish, but do not attack people.

Feel free to take this to the Twitter timeline too and tag me and anyone.